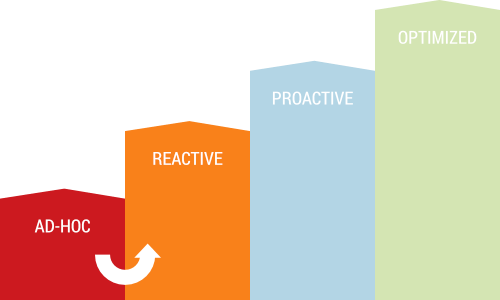

Deduction Management Maturity Model

The diagram below presents the Deduction Management Maturity Model developed by Attain Consulting Group. The model outlines the typical characteristics of companies in various stages of development across the deduction management continuum looking at six different key components: Management of Customer Requirements, Cross-Functional Collaboration, Deduction Management Processes, Use of Technology, Trading Partner Relationship (non-sales related) and Trade Promotion Management.

To evaluate your performance, look at each of the components (rows) and select the characteristics which best describe your company. This will give you an indication of where your company currently falls on the deduction management continuum – Ad Hoc, Reactive, Proactive or Optimized.

The closer your company is to the Optimized section of the diagram, the more advanced your deduction management processes. Consider the characteristics of companies further along the continuum to understand the characteristics of best in class processes and use this information to develop your improvement plans. This is a great tool to review with senior management when discussing improvement opportunities.

Moving from Ad Hoc to Reactive

The move from Ad Hoc to Reactive is a realistic achievement for most companies once areas for improvement have been identified and the processes outlined to achieve your goals. Companies often find that bringing in an outside expert to provide guidance and a new perspective can help jump start the process. Often the most difficult thing is changing the corporate culture to adopt the new processes and internal disciplines. It is critical to get senior management buy-in and support in driving the change. Since you will be driving change into the organization, this may be an excellent time to consider implementing new leading edge technologies that will enable you to move even further along the deduction management maturity model.

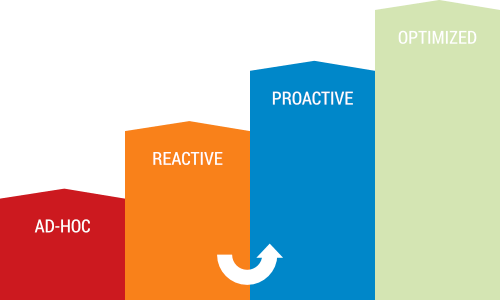

Moving from Reactive to proactive

The evolution from Reactive to Proactive on the Deduction Management Maturity Model is a substantial change in operations, but one that typically results in tremendous financial benefit. It involves actively involving other departments in your organization and utilizing leading edge technology to automate manual tasks, freeing up the resources needed to mandate and implement dramatic process improvements. It involves opening up your operations to internal and external collaboration, creating visibility, accountability, and more opportunity for identifying improvement. This evolution requires a good deal senior management support, business needs analysis and planning to achieve a successful rollout, but the payoff will be well worth it!

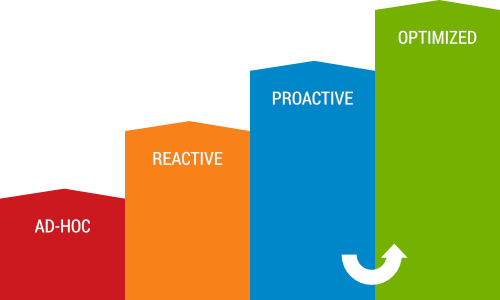

Becoming optimized

The evolution from Proactive to Optimized on the Deduction Management Maturity Model mostly involves the fine tuning of processes you already have in place as well as the further adoption of leading edge technology that will free up resources to give you the ability to further focus on streamlining the resolution process as well as early detection and prevention of deductions. Optimized companies are often using the “latest and greatest” technologies to help them automate cash application, research, validation, dispute processing, workflow and reporting.

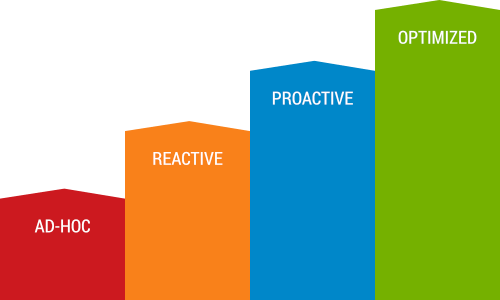

Staying optimized

You’re really on top of your game! You’ve done what you need to do to manage deductions with the greatest success. Now, you just need to continue to perfect your processes and implement the technology to be more automated and collaborative, as well as use your data to start performing more sophisticated trend analyses. Remember that deduction management is an ongoing process and you need to work to continue to maintain your Optimized level.